The Main Story

We have finally arrived at the main story: what we need to do to solve the climate problem, and how we can save the future for our grandchildren.

The problem demands a solution with a clear framework and a strong backbone. Yes, I know that halting and reversing the growth of carbon dioxide in the air requires an "all hands on deck" approach — there is no "silver bullet" solution for world energy requirements. People need to make basic changes in the way they live. Countries need to cooperate. Matters as seemingly intractable as population must be addressed. And the required changes must be economically efficient. Such a pathway exists and is achievable.

Let's define what a workable backbone and framework should look like. The essential backbone is a rising price on carbon applied at the source (the mine, wellhead, or port of entry), such that it would affect all activities that use fossil fuels, directly or indirectly. Our goal is a global phaseout of fossil fuel carbon dioxide emissions. We have shown, quantitatively, that the only practical way to achieve an acceptable carbon dioxide level is to disallow the use of coal and unconventional fossil fuels (such as tar sands and oil shale) unless the resulting carbon is captured and stored. We realize that remaining, readily available pools of oil and gas will be used during the transition to a post-fossil-fuel world. But a rising carbon price surely will make it economically senseless to go after every last drop of oil and gas — even though use of those fuels with carbon capture and storage may be technically feasible and permissible.

Global phaseout of fossil fuel carbon dioxide emissions is a stringent requirement. Proposed government policies, consisting of an improved Kyoto Protocol approach with more ambitious targets, do not have a prayer of achieving that result. Our governments are deceiving us, and perhaps conveniently deceiving themselves, when they say that it is possible to reduce emissions 80 percent by 2050 with such an approach.

A simple proof of the contrary is provided by reviewing the Kyoto results. Japan is an exemplary world citizen and was the strongest promoter of the Kyoto protocol, so quantification of its performance is informative. Japan agreed to reduce emissions 6 percent below 1990 levels, made an honest effort, and played by the rules. What was the result? In August 2009 Japan announced that its emissions exceeded 1990 levels by 9 percent — missing its target by 15 percent. Japan will reduce the huge gap between target and reality by purchasing offsets of 1.6 percent via the Clean Development Mechanism and 3.8 percent via funding of tree planting. Unfortunately, these offsets are not meaningful, as I will explain. But even if we count them, Japan is nowhere near its target.

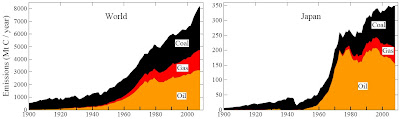

FIGURE 25: Fossil fuel emissions by fuel type for the world and Japan. (Data sources are Carbon Dioxide Information Analysis Center, Oak Ridge National Laboratory, and British Petroleum.)

FIGURE 25: Fossil fuel emissions by fuel type for the world and Japan. (Data sources are Carbon Dioxide Information Analysis Center, Oak Ridge National Laboratory, and British Petroleum.)The world as a whole did much more poorly than Japan, as shown in figure 25. Results fluctuated from place to place, depending on historical accidents, not on anything that the Kyoto Protocol engendered. Germany did well because it incorporated East Germany and closed down dirty, inefficient communist-era factories. The U.K. did well because North Sea gas allowed it to close most coal mines and replace coal-fired power with gas. But overall, global emissions shot up faster than Japan's.

A successful new policy cannot include any offsets. We specified the carbon limit based on the geophysics. The physics does not compromise — it is what it is. And planting additional trees cannot be factored into the fossil fuel limitations. The plan for getting back to 350 ppm assumes major reforestation, but that is in addition to the fossil fuel limit, not instead of. Forest preservation and reforestation should be handled separately from fossil fuels in a sound approach to solve the climate problem.

The public must be firm and unwavering in demanding "no offsets," because this sort of monkey business is exactly the type of thing that politicians love and will try to keep. Offsets are like the indulgences that were sold by the church in the Middle Ages. People of means loved indulgences, because they could practice any hanky-panky or worse, then simply purchase an indulgence to avoid punishment for their sins. Bishops loved them too, because they brought in lots of moola. Anybody who argues for offsets today is either a sinner who wants to pretend he or she has done adequate penance or a bishop collecting moola.

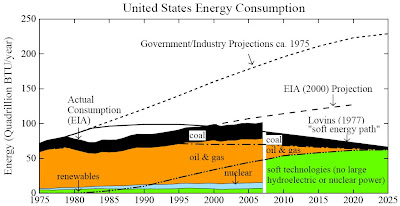

FIGURE 2: U.S. energy consumption falls well below government and industry projections, even below projections made by the Department of Energy's Energy Information Administration (EIA) in 2000. However, Amory B. Lovin's projection (in Soft Energy Path: Toward a Durable Peace, Penguin Books, 1977) that fossil fuels, nuclear power, and large hydroelectric power would all be largely replaced by small-scale renewable energy has also proved to be inaccurate.

FIGURE 2: U.S. energy consumption falls well below government and industry projections, even below projections made by the Department of Energy's Energy Information Administration (EIA) in 2000. However, Amory B. Lovin's projection (in Soft Energy Path: Toward a Durable Peace, Penguin Books, 1977) that fossil fuels, nuclear power, and large hydroelectric power would all be largely replaced by small-scale renewable energy has also proved to be inaccurate.Let us return one more time to figure 2 of chapter 2 (page 21), which provides an overview of prospective actions for phasing out carbon emissions. First, this graph illustrates a mistake made by energy professionals that continues to be made today. It shows that energy use in the United States grew far more slowly than energy experts predicted. Growth of energy use was moderate despite strong economic growth and an unexpectedly rapid population expansion fueled by immigration. For one decade, beginning in the late 1970s, energy use did not even increase, as a consequence of imposed improvements on vehicle fuel efficiency, escalating energy prices in the wake of the second "oil shock," and widespread cost overruns in the electricity sector.

Nevertheless, be prepared for energy experts telling you that a kazillion units of energy will be needed in 2050 or 2100. They will calculate how many square miles of solar power plants must be built every day or how many nuclear power plants must be built every year, and then they will wring their hands and perhaps try to sell you something. Yes, energy use is going to increase — mainly because parts of the world are developing rapidly and raising their standards of living and energy use. But energy growth need not be exceedingly rapid — figure 2 shows that energy use hardly grew during rapid economic growth in the world's largest economy, even though the great potential of energy efficiency was barely tapped. Also remember that the solution to the climate problem requires a phasedown of carbon emissions, not necessarily a phasedown of energy use. We will need to slow the energy growth rate and decarbonize our energy sources to solve the problem.

However, the growth rate of energy use is an important aspect of the problem, and we can gain further insight from the U.S. energy consumption curve (figure 2). The U.S. population has increased 50 percent since 1975, but energy use per person has not increased. The United States actually could have achieved much greater energy efficiency over this period, but there has been little economic incentive to do so since energy costs have been declining in real terms, or as a fraction of a person's budget. People are happy to drive gas-guzzlers when gasoline is cheap. Vehicle fuel-efficiency requirements were increased in 2009 in the U.S. by about 30 percent, to 35.5 miles per gallon, the only increase since the late 1970s, when the efficiency was nearly doubled to about 24 miles per gallon. Except in California, utility companies make more money when they sell more energy, so they have no incentive to conserve. Improved efficiency standards for appliances caused household energy use to decline in the U.S., until the proliferation of electronic devices that consume energy even in standby mode and a marked growth in the size of homes offset these improvements. Building-efficiency standards could have averted increased energy use, but even the existing weak standards have been difficult to enforce. High energy costs provide the most effective enforcement, because continual inspections are impractical.

Again, the solution to the climate problem requires the phasing out of carbon emissions from fossil fuels. But figure 2 shows this is not happening, because carbon capture is not being used with any of these fossil fuels. Contrary to Lovins's projection, "soft" renewable energies remain imperceptibly small. The largest carbon-free energy source is nuclear, which Lovins would eliminate. The main renewable energy source currently in use is hydroelectric, provided by large hydropower projects built in the middle of the twentieth century, which Lovins also would eliminate. The second-largest renewable energy source is biomass burning, whose "softness" is questionable. Coal, oil, and gas provide most U.S. energy. I have discussed figure 2 with Lovins, suggesting that a phasedown of fossil fuels requires a carbon tax. Lovins says that a tax is not needed.

It is no wonder that Lovins is hugely popular on the rubber-chicken circuit. But it is dangerous to listen to a siren without checking real-world data. Figure 2 shows that progress toward the all-soft-energies track has been teeny-tiny compared with what is needed. Kidding ourselves that the world will suddenly move onto the soft-energy path would sentence our grandchildren to an unhappy, deadly future.

Why do fossil fuels continue to provide most of our energy? The reason is simple. Fossil fuels are the cheapest energy. This is in part due to their marvelous energy density and the intricate energy-use infrastructure that has grown up around fossil fuels. But there is another reason: Fossil fuels are cheapest because we do not take into account their true cost to society. Effects of air and water pollution on human health are borne by the public. Damages from climate change are also falling on the public, but they will be borne especially by our children and grandchildren.

How can we fix the problem? The solution necessarily will increase the price of fossil fuel energy. We must admit that. In the end, energy efficiency and carbon-free energy can surely be made less expensive than fossil fuels, if fossil fuels' cost to society is included. The difficult part is that we must make the transition with extraordinary speed if we are to avert climate disaster.

Rather than immediately defining a proposed framework for a solution, which may appear to be arbitrary without further information, we need to first explore the problem and its practical difficulties. Two alternative legislative actions have been proposed in the United States: "fee-and-dividend" and "cap-and-trade." Let's begin by looking at the simpler approach, fee-and-dividend. In this method, a fee is collected at the mine or port of entry for each fossil fuel (coal, oil, and gas), i.e., at its first sale in the country. The fee is uniform, a single number, in dollars per ton of carbon dioxide in the fuel. The public does not directly pay any fee or tax, but the price of the goods they buy increases in proportion to how much fossil fuel is used in their production. Fuels such as gasoline or heating oil, along with electricity made from coal, oil, or gas, are affected directly by the carbon fee, which is set to increase over time. The carbon fee will rise gradually so that the public will have time to adjust their lifestyle, choice of vehicle, home insulation, etc., so as to minimize their carbon footprint.

Under fee-and-dividend, 100 percent of the money collected from the fossil fuel companies at the mine or well is distributed uniformly to the public. Thus those who do better than average in reducing their carbon footprint will receive more in the dividend than they will pay in the added costs of the products they buy.

The fee-and-dividend approach is straightforward. It does not require a large bureaucracy. The total amount collected each month is divided equally among all legal adult residents of the country, with half shares for children, up to two children per family. This dividend is sent electronically to bank accounts, or for people without a bank account, to their debit card.

As an example, consider the point in time at which the fee will reach the level of $1 15 per ton of carbon dioxide. A fee of that level will increase the cost of gasoline by $1 per gallon and the average cost of electricity by around 8 cents per kilowatt-hour. Given the amount of oil, gas, and coal sold in the United States in 2007, $115 per ton will yield $670 billion. The resulting dividend will be close to $3,000 per year, or $250 per month, for each legal adult resident; a family with two or more children will receive in the range of $8,000 to 9,000 per year.

Fee-and-dividend is a progressive tax. For example, my friend Al Gore (I hope he is still my friend after this book is published) will pay a heck of a lot more than $9,000 in added costs because he owns large houses and flies around the world a lot. Given the current distribution of wealth and lifestyles, about 40 percent of people will pay more in added costs than they will get back in their dividend. For the most part, it will be those with high incomes who pay more, but not always. A poor guy who commutes a hundred miles to work every day in a clunker may pay more than he gets in his dividend (although perhaps not, if he lives in a modest-size house, doesn't do a lot of recreational motoring, and rarely takes airplane trips). Sorry, poor guy, but it is those kinds of practices that will be changed, in the long run, by a rising carbon fee. The cost will encourage the poor guy to figure out more efficient transportation or live closer to his work.

By the way, Al Gore agrees that fee-and-dividend is the best way to reduce carbon emissions, but his proposal is to reduce payroll taxes rather than give dividends to the public. I prefer the dividend because I don't trust the government to make the tax reduction balance out the fee. Also, not everybody is on a payroll. A dividend is just simpler.

Few activities would be unaffected by a carbon fee-and-dividend. Today we often import food from halfway around the world, rather than from a nearby farm, in part because there is no tax on aviation fuel. Why? Lobbying. A deal was made in the 1940s to encourage the budding aviation industry — and lobbying makes it hard to get rid of sweet deals. All sweet deals will be wiped off the books by a uniform carbon fee at the source, which will affect all fossil fuel uses.

I'm asked, "If people get a dividend, won't they just go out and spend that money on their gas-guzzler or whatever fossil fuels they have been using?" Maybe they will at first, but in the long run they will tend to adjust their decisions on vehicle choice and other matters as the carbon price gradually continues to rise.

A rising carbon price does not eliminate the need for efficiency regulations, but it makes them work much better. Building codes, for example, usually have energy efficiency requirements, but every city finds that they are impossible to enforce well. The builder changes things after inspection, or the building operation is simply inefficient. The best enforcement is carbon price — as the fuel price rises, people pay attention to waste.

Economists are almost unanimous that a uniform rising carbon fee is the least costly way to phase out fossil fuels. This allows proper competition between energy efficiency and alternative carbon-free energy sources such as solar energy, wind, and nuclear power. It also "internalizes" the incentive to reduce the use of carbon fuels, especially coal, in literally billions of decisions ranging from commuting behavior to the design of vehicles, aircraft, cities, and so forth.

"Wait a minute," you may be saying. "This carbon fee doesn't sound like the deal I have been hearing about." You are right. Most of the talk is about cap-and-trade, the basis of proposed legislation being considered by Congress, specifically Representatives Henry Waxman and Ed Markey's American Clean Energy and Security Act. Cap-and-trade is what governments and the people in alligator shoes (the lobbyists for special interests) are trying to foist on you.

Whoops. As an objective scientist I should delete such personal opinions, or at least flag them. But I am sixty-eight years old, and I am fed up with the way things are working in Washington. Foolishly, I imagined that we might really get "change" in the way things worked there. As I said, I was among those who had moist eyes on Election Day in November 2008, when President-elect Obama gave his speech in Chicago. But things are still done in the same way in Washington. No doubt I was naive to think that it might be otherwise, and, unfortunately, so were millions of young people.

I am not blaming President Obama. On the contrary, he is still our best hope. But he must actually look into this matter, not rely on watered-down advice from his sources of information and advisers. The leaders Obama appointed in science and energy are the most knowledgeable people in the field, but there are many others in his inner circle of advisers. The stakes in the policy adopted for energy and climate are too great to be based on aggregate advice or a sum of political compromises. The present situation is analogous to that faced by Lincoln with slavery and Churchill with Nazism — the time for compromises and appeasement is over.

It is hard to blame anybody in Obama's circle of advisers, even though I detest the tactics that have infested American politics. It seems to be believed that if you don't have tough guys around you, guys who can deliver tit for tat, counterblows to attacks from the other side, maybe with similar tactics, you will soon be on the outside, looking in at somebody else governing. I don't know, maybe that is true. But I also believe that the public can appreciate a principled stand, even one that takes political hits, if it is properly explained.

The reason it is hard for me to blame Obama's advisers is that I see where they are getting their information. It is from good people, our friends, the people who are believed to be the most supportive of the environment, including climate preservation. I refer to some members of Congress who are among those with the strongest environmental voting records, such as Waxman and Markey, and I refer especially to organizations such as the Environmental Defense Fund, the Natural Resources Defense Council, and the Pew Foundation.

People tell me, "You must be wrong, because the polluters are opposed to cap-and-trade, so cap-and-trade must be good." Sure, those in the fossil fuel industry would prefer no regulations at all, so that is their first choice — they stall any action as long as possible. But they know that something is coming down the pike. And they are spending enormous amounts of money to be sure that cap-and-trade is doctored to allow as much business-as-usual emissions to continue as long as possible.

Let's discuss cap-and-trade explicitly first. Then I will provide a bottom-line proof that it cannot work. Because I have already made up my mind about the uselessness of cap-and-trade, my commentary may be slanted, but you have been warned, so you should be able to make up your own mind.

In cap-and-trade, the amount of a fossil fuel for sale is supposedly "capped." A nominal cap is defined by selling a limited number of certificates that allow a business or speculator to buy the fuel. So the fuel costs more because you must pay for the certificate and the fuel. Congress thinks this will reduce the amount of fuel you buy — which may be true, because it will cost you more. Congress likes cap-and-trade because it thinks the public will not figure out that a cap is a tax.

How does the "trade" part factor in? Well, you don't have to use the certificate; you can trade it or sell it to somebody else. There will be markets for these certificates on Wall Street and such places. And markets for derivatives, The biggest player is expected to be Goldman Sachs. Thousands of people will be employed in this trading business — the big boys, not guys working for five dollars an hour. Are you wondering who will provide their income? Three guesses and the first two don't count. Yes, it's you — sorry about that. Their profits are also added to the fuel price.

What is the advantage of cap-and-trade over fee-and-dividend, with the fee distributed to the public in equal shares? There is an advantage to cap-and-trade only for energy companies with strong lobbyists and for Congress, which would get to dole out the money collected in certificate selling, or just give away some certificates to special interests. Don't hurry to write a letter to your congressional representative asking for a certificate to pollute — that's not how things work in Washington. Your paragraph requesting a certificate is not likely to be included in the Waxman-Markey bill, even though at last count 1,400 pages had been added. Again, think lobbyists. Think revolving doors. People in alligator shoes write the paragraphs that actually get added. If you think I am kidding, ask yourself this: Do you believe that your representatives in Congress can write 1,400 pages themselves? It is still a free country, so you can hire your own lobbyist, but the price is kind of high. A coal company can afford someone like Dick Gephardt — can you?

Okay, I will try to be more specific about why cap-and-trade will be necessarily ineffectual. Most of these arguments are relevant to other nations as well as the United States.

First, Congress is pretending that the cap is not a tax, so it must try to keep the cap's impact on fuel costs small. Therefore, the impact of cap-and-trade on people's spending decisions will be small, so necessarily it will have little effect on carbon emissions. Of course that defeats the whole purpose, which is to drive out fossil fuels by raising their price, replacing them with efficiency and carbon-free energy.

The impact of cap-and-trade is made even smaller by the fact that the cap is usually not across the board at the mine. In the fee-and-dividend system, a single number, dollars per ton of carbon dioxide, is applied at the mine or port of entry. No exceptions, no freebies for anyone, all fossil fuels covered for everybody. In cap-and-trade, things are usually done in a more complicated way, which allows lobbyists and special interests to get their fingers in the pie. If the cap is not applied across the board, covering everything equally, any sector not covered will benefit from reduced fuel demand, and thus reduced fuel price. Sectors not covered then increase their fuel use.

In contrast, the fee-and-dividend approach puts a rising and substantial price on carbon. I believe that the public, if honestly informed, will accept a rise in the carbon fee rate because their monthly dividend will increase correspondingly.

Second, the cap-and-trade target level for emissions (defined by the number of permits) sets a floor on emissions. Emissions cannot go lower than this floor, because the price of permits on the market would crash, bringing down fossil fuel prices and again making it more economical for profit-maximizing businesses to burn fossil fuels than to employ energy-efficiency measures and renewable-energy technology. It would be akin to a drug dealer luring back former customers by offering free cash along with a free fix.

With fee-and-dividend, in contrast, we will reach a series of points at which various carbon-free energies and carbon-saving technologies are cheaper than fossil fuels plus their fee. As time goes on, fossil fuel use will collapse, remaining coal supplies will be left in the ground, and we will have arrived at a clean energy future. And that is our objective.

A perverse effect of the cap-and-trade floor is that altruistic actions become meaningless. Say that you are concerned about your grandchildren, so you decide to buy a high-efficiency little car. That will reduce your emissions but not the country's or the world's; instead it will just allow somebody else to drive a bigger SUV. Emissions will be set by the cap, not by your actions.

In contrast, the fee-and-dividend approach has no floor, so every action you take to reduce emissions helps. Indeed, your actions may also spur your neighbor to do the same. That snowballing (amplifying feedback) effect is possible with fee-and-dividend, but not with cap-and-trade.

Third, offsets cause actual emission reductions to be less than targets, because emissions covered by an offset do not count as emissions. They don't count as emissions to the politicians, but they sure count to the planet! For example, actual reductions under the Waxman-Markey bill have been estimated to be less than half of the target, because of offsets.

Fourth, Wall Street trading of emission permits and their derivatives in the anticipated multitrillion-dollar carbon market, along with the demonstrated volatility of carbon markets, creates the danger of Wall Street failures and taxpayer-funded bailouts. In the best case, if market failures are avoided, there is the added cost of the Wall Street trading operation and the profits of insider trading. To believe that there will be no insider profits is to believe that government overseers are more clever than all the people on Wall Street and that there is no revolving door between Wall Street and Washington. Where will Wall Street profits come from? They too will come from John Q. Public via higher energy prices.

In contrast, a simple flat fee at the mine or well, with simple long division to determine the size of the monthly dividend to all legal residents, provides no role for Wall Street. Could that be the main reason that Washington so adamantly prefers cap-and-trade?

Fee-and-dividend is revenue neutral to the public, on average. Cap-and-trade is not, because we, the public, provide the profits to Wall Street and any special interests that have managed to get written into the legislation. Of course Congress will say, "We will keep the cost very low, so you will hardly notice it." The problem is, if it's too small for you to notice, then it is not having an effect. But maybe Congress doesn't really care about your grandchildren.

Hold on! Or so you must be thinking. If cap-and-trade is so bad, why do environmental organizations such as the Environmental Defense Fund and the National Resources Defense Council support it? And what about Waxman and Markey, two of the strongest supporters of the environment among all members of the House of Representatives ?

I don't doubt the motives of these people and organizations, but they have been around Washington a long time. They think they can handle this problem the way they always have, by wheeling and dealing. Environmental organizations "help" Congress in the legislative process, just as the coal and oil lobbyists do. So there are lots of "good" items in the 1,400 pages of the Waxman-Markey bill, such as support for specific renewable energies. There may be more good items than bad ones — but unfortunately the net result is ineffectual change. Indeed, the bill throws money to the polluters, propping up the coal industry with tens of billions of taxpayer dollars and locking in coal emissions for decades at great expense.

Yet these organizations say, "It is a start. We will get better legislation in the future." It would surely require continued efforts for many decades, but we do not have many decades to straighten out the mess.

The beauty of the fee-and-dividend approach is that the carbon fee helps any carbon-free energy source, but it does not specify these sources; it lets the consumer choose. It does not cost the government anything. Whether it costs citizens, and how much, depends on how well they reduce their carbon footprint.

A quantitative comparison of fee-and-dividend and cap-and-trade has been made by economist Charles Komanoff (www.komanoff .net/fossil/CTC_Carbon_Tax_Model.xls). If the carbon fee increases by $12.50 per ton per year, Komanoff estimates that U.S. carbon emissions in 2020 would be 28 percent lower than today. And that is without the snowballing (amplifying feedback) effect I mentioned above. By that time the fee would add just over a dollar to the price of a gallon of gasoline, but the reduction in fossil fuel use would tend to reduce the price of raw crude. The 28 percent emissions reduction compares with the Waxman-Markey bill goal of 17 percent — which is, however, fictitious because of offsets. This approach, small annual increases of the carbon fee (ten to fifteen dollars per ton per year), is essentially the bill proposed by Congressman John B. Larson, a Democrat in the U.S. House of Representatives. Except Larson proposes using the money from the fee to reduce payroll taxes, rather than to pay a dividend to legal residents. The Democratic leadership and President Obama, so far, have chosen to ignore Congressman Larson.

A final comment on cap-and-trade versus fee-and-dividend. Say an exogenous development occurs, for example, someone invents an inexpensive solar cell or an algae biofuel that works wonders. Any such invention will add to the 28 percent emissions reduction in the fee-and-dividend approach. But the 17 percent reduction under cap-and-trade will be unaffected, because the cap is a floor. Permit prices would fall, so energy prices would fall, but emission reductions would not go below the floor. Cap-and-trade is not a smart approach.

But, you may ask, was it not proven with the acid rain problem that cap-and-trade did a wonderful job of reducing emissions at low cost? No, sorry, that is a myth — and worse. In fact, examination of the story about acid rain and power plant emissions shows the dangers in both horse-trading with polluters and the cap-and-trade floor. Here is essentially how the acid rain "solution" worked. Acid rain was caused mainly by sulfur in coal burned at power plants. A cap was placed on sulfur emissions, and power plants had to buy permits to emit sulfur. Initially the permit price was high, so many utilities decided to stop burning high-sulfur coal and to replace it with low-sulfur coal from Wyoming. From 1990 to today, sulfur emissions have been cut in half. A smaller part of the reduction was from the addition of sulfur scrubbers to some power plants that could install them for less than the price of the sulfur permits, but the main solution was use of low-sulfur coal. Now what the dickens does that prove?

It proves that in a case where there are a finite number of point sources, and there are simple ways to reduce the emissions, and you are satisfied to just reduce the emissions by some specified fraction, then emission permits make sense. The utilities that were closest to the Wyoming coal or that needed to install scrubbers for other reasons could reduce their emissions, and so overall the cost of achieving the specified reduction of sulfur emissions was minimized. But the floor of this cap-and-trade approach prevented further reductions. Analyses have shown that the economic benefits of further reductions would have exceeded costs by a factor of twenty-five. So, in some sense, the acid rain cap-and-trade solution was an abject failure.

It is worse than that. The horse-trading that made coal companies and utilities willing to allow this cap-and-trade solution did enormous long-term damage. (What do I mean by "coal companies and utilities willing to allow"? That is the way it works in Washington. Special interests have so much power, or Congress chooses to give them so much sway, that their assent is needed.) The horse-trading was done in 1970. Senator Edmund Muskie, one of the best friends that the environment has ever had, felt it was necessary to compromise with the coal companies and utilities when the 1970 Clean Air Act was defined. So he allowed old coal-fired power plants to be "grandfathered": they would be allowed to continue to pollute, because they would soon be retired anyhow, or so the utilities said. Like fun they would. Those old plants became cash cows once they were off the pollution hook — the business community will never let them die, Thousands of environmentalists have been fighting those plants and trying to adjust clean air regulations ever since. Yet today, in 2009, there are still 145 operating coal-fired power plants in the United States that were constructed before 1950. Two thirds of the coal fleet was constructed before the Clean Air Act of 1970 was passed.

Those people, including the leaders of our nation, who tell you that the acid rain experience shows that cap-and-trade will work for the climate problem do not know what they are talking about. The experience with coal-fired power plants does contain important lessons, though.

First, it shows that the path we start on is all-important. People who say that cap-and-trade is a good start and we will move on from there are not looking at reality. Four decades later we are still paying for an early misstep with coal-fired plants.

Second, it shows that we need a simple, across-the-board solution that covers all emissions. A fee or tax must be applied at the source. If Congress insists that it must help somebody who will be hurt by the carbon fee, such as coal miners, fine — Congress can provide for job retraining or some other compensation. But the fee on fossil fuel carbon must be uniform at the source, with no exceptions.

Finally, let me address the ultimate defense that is used for cap-and-trade: ''The train has left the station. It is too late to change. President Obama has decided. The world has decided. It must be cap-and-trade, because an approach such as you are talking about would delay things too much." That latter claim turns truth on its head, calling black "white" and white "black." The truth is shown by empirical evidence. In February 2008, British Columbia decided to adopt a carbon tax with an equal reduction of payroll taxes. Five months later it was in place and working. This year there was an election in British Columbia in which the opposition party campaigned hard against the carbon tax. They lost. The public liked the carbon tax with a payroll tax reduction. Now both parties support it. In contrast, it took a decade to negotiate the cap-and-trade Kyoto Protocol, and many countries had to be individually bribed with concessions. The result: slow implementation and an ineffectual reduction of emissions. The Waxman-Markey bill is following a similar path.

FIGURE 26. Fossil fuel carbon dioxide emissions relative to 2008 if coal emissions are phased out over the 2010-2030 period and unconventional fossil fuels are not developed. The larger EIA oil and gas reserve estimate reflects aggressive explanation of potential reserves. (Data from Hansen et al., "Target Atmospheric CO2," See sources for chapter 8.)

FIGURE 26. Fossil fuel carbon dioxide emissions relative to 2008 if coal emissions are phased out over the 2010-2030 period and unconventional fossil fuels are not developed. The larger EIA oil and gas reserve estimate reflects aggressive explanation of potential reserves. (Data from Hansen et al., "Target Atmospheric CO2," See sources for chapter 8.)I almost forgot that I had agreed to provide a proof that the approach pursued by governments today cannot conceivably yield their promise of an 80 percent emission reduction by 2050. It is an easy proof. An 80 percent reduction in 2050 is just what occurs if coal emissions are phased out between 2010 and 2030, as shown in figure 26. This is based on the moderate oil and gas reserves estimated by IPCC — implying also that we cannot go after the last drops of oil. First ask if governments are building any new coal plants. The answer: "Lots of them." Then ask how they will persuade the major oil-producing nations to leave their oil in the ground. The answer: "Duh." Proof complete.

Okay, at long last, we can address the fundamental problem. What is the backbone and framework for a solution to human-caused climate change?

The backbone must be a rising fee (tax) on carbon-based fuels, uniform across the board. No exceptions. The money must be returned to the public in a way that is direct, so they realize and trust that (averaged over the public) the money is being returned in full. Otherwise the rate will never be high enough to do the job. Returning the money to the public is the hard part in the United States. Congress prefers to keep the money for itself and divvy it out to special interests.

The framework concerns how to make an across-the-board fee on fossil fuel carbon work on a global basis, in a way that is fair, because unless there is a universal carbon fee, it will be ineffective. The backbone, I will argue, makes it relatively simple to define international arrangements — I will explain what I mean by "relatively simple" in a moment. The backbone also makes it practical to have a framework that deals with the problem of fairness between those who have caused the problem, those who are causing the problem, and those who are primarily the victims of others. The framework can also help deal with the fundamental problems of population and poverty.

Contrary to the assertion by proponents of a Kyoto-style cap-and-trade agreement, cap-and-trade is not the fastest way to an international agreement. That assertion is another case of calling black "white," apparently under the assumption that the listener will accept it without thinking. A cap-and-trade agreement will be just as hard to achieve as was the Kyoto Protocol. Indeed, why should China, India, and the rest of the developing world accept a cap when their per-capita emissions are an order of magnitude less than America's or Europe's? Leaders of developing countries are making that argument more and more vocally. Even if differences are papered over to achieve a cap-and-trade agreement at upcoming international talks, the agreement is guaranteed to be ineffectual. So eventually (quickly, I hope!) it must be replaced with a more meaningful approach. Let's define one.

The key requirement is that the United States and China agree to apply across-the-board fees to carbon-based fuels. Why would China do that? Lots of reasons. China is developing rapidly and it does not want to be saddled with the fossil fuel addiction that plagues the United States. Besides, China would be hit at least as hard as the United States by climate change. The most economically efficient way for China to limit its fossil fuel dependence, to encourage energy efficiency and carbon-free energies, is via a uniform carbon fee. The same is true for the United States. Indeed, if the United States does not take such an approach, but rather continues to throw lifelines to special interests, its economic power and standard of living will deteriorate, because such actions make the United States economy less and less efficient relative to the rest of the world.

Agreement between the United States and China comes down to negotiating the ratio of their respective carbon tax rates. In this negotiation the question of fairness will come up — the United States being more responsible for the excess carbon dioxide in the air today despite its smaller population. That negotiation will not be easy, but once both countries realize they are in the same boat and will sink or survive together, an agreement should be possible.

Europe, Japan, and most developed countries would likely agree to a status similar to that of the United States. It would not be difficult to deal with any country that refuses to levy a comparable across-the-board carbon fee. An import duty could be collected by countries importing products from any nation that does not levy such a carbon fee. The World Trade Organization already has rules permitting such duties. The duty would be based on standard estimates of the amount of fossil fuels that go into producing the imported product, with the exporting company allowed the option of demonstrating that its product is made without fossil fuels, or with a lesser amount of them. In fact, exporting countries would have a strong incentive to impose their own carbon fee, so that they could keep the revenue themselves.

As for developing nations, and the poorest nations in the world, how can they be treated fairly? They also must have a fee on their fossil fuel use or a duty applied to the products that they export. That is the only way that fossil fuels can be phased out. If these countries do not have a tax on fossil fuels, then industry will move there, as it has moved already from the West to China and India, with carbon pollution moving along with it. Fairness can be achieved by using the funds from export duties, which are likely to greatly exceed foreign aid, to improve the economic and social well-being of the developing nations.

I do not want to wander far into these subjects, but it would be inappropriate not to mention the connection between population and climate change. The stress that humans place on the planet and other species on the planet is closely related to human population growth. Stabilization of atmospheric composition and climate almost surely requires a stabilization of human population.

The encouraging news is that there is a strong correlation between reduced fertility rates, increased economic well-being, and women's rights and education. Many Western countries now have fertility rates below or not far from the replenishment level. The substantial funds that will necessarily be generated by an increasing fee on fossil fuel carbon should be used to reward the places that encourage practices and rights that correlate with sustainable populations.

In summary, the backbone of a solution to the climate problem is a flat carbon emissions price applied across all fossil fuels at the source. This carbon price (fee, tax) must rise continually, at a rate that is economically sound. The funds must be distributed back to the citizens (not to special interests) — otherwise the tax rate will never be high enough to lead to a clean energy future. If your government comes back and tells you that it is going to have a'"goal" or "target" for carbon emission reductions, even a "mandatory" one, you know that it is lying to you, and that it doesn't give a damn about your children or grandchildren. For the moment, let's assume that our governments will see the light.

Once the necessity of a backbone flat carbon price across all fossil fuel sources is recognized, the required elements for a framework agreement become clear. The principal requirement will be to define how this tax rate will vary between nations. Recalcitrance of any nations to agree to the carbon price can be handled via import duties, which are permissible under existing international agreements. The framework must also define how proceeds of carbon duties will be used to assure fairness, encourage practices that improve women's rights and education, and help control population. A procedure should be defined for a regular adjustment of funds' distribution for fairness and to reward best performance.

Well, what happens if, instead of accepting the need for a rising carbon price, our governments continue to deceive us, setting goals and targets for carbon emissions reductions?

In that case we had better start thinking about the Venus syndrome.